All of the Following Are Types of Fidelity Bonds Except

The principal the surety and the obligee. If the concession per bond were 2 per bond the total concession for 10 bonds would be 10 X 2 20.

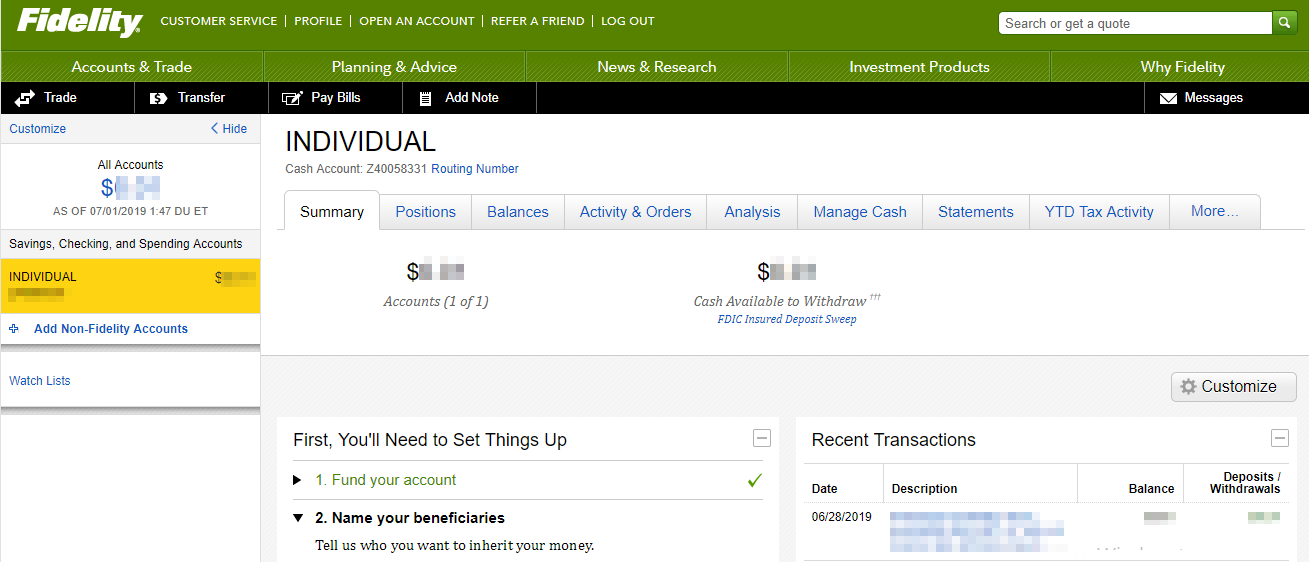

Fidelity Review 2022 Pros And Cons Uncovered

Fidelity bonding is one branch of the surety business.

. This bond does not cover loss directly or indirectly from trading actual or fic -. The first of these is the ERISA bond which is purchased to protect your employee retirement fund against embezzlement by the managing employee. In the context of a secondary bond trade the effective yield is inclusive of the quoted price plus the total cost or markup of the transaction.

The Insured and any natural person except a director or trustee of the Insured if a corporation who is not also an officer or employee thereof in some other capacity while in the regular service of the Insured in the ordinary course of the Insureds business and whom the. General liability coverage C. A Fidelity Bond is an insurance policy that protects companies against financial loss due to employee fraud and theft.

In a company with 1-5 employees an effective way to prevent employee fraud involving company checks or bank. An obligee may be a person firm corporation government or an agency of a government. The bond amount is based on plan assets.

B Blanket Bond. The party in whose favor a bond runs. FIDELITY BOND APPLICATION BOND Type of Labor Organization Bond.

The process of a neutral third party making a decision on a disputed claim is called. At 353 155 NE. Losses from forged deposits or forged credit cards c.

Employees are seldom asked to enter into a written agreement to perform their duties honestly but there is an implied contract that employees will act in the best interest of their employers. Third-party fidelity bonds protect businesses against intentionally wrongful acts committed by people working for them on a contract basis eg consultants or independent contractors. A bond may be quoted with an Ask Price of 10100 and a corresponding Ask Yield of 560.

Fidelity bonds are simply a type of crime insurance product that protects businesses from specific fraudulent acts. 24 C There are three parties to a surety bond. All the Insureds offices or premises in existence at the time this bond becomes effective are covered under this bond except the offices or premises located as follows.

A blanket position bond B. Paul Fire. ET for all Municipal Resets except for those that reset on a daily basis where the cut-off time for placing orders is 945 am.

Losses from counterfeit paper currency or money orders b. The use of fidelity bonds protects a company from embezzlement loses and also. All of the following statements regarding fidelity bond requirements are TRUE EXCEPT.

Court Bond B Individual Bond C Blanket Bond D Position Schedule Bond. Generally the maximum bond amount is 500000. This often involves examination of a credit report and the provision of company financial information.

Like all bonds a fidelity bond guarantees a contract made between two parties. Both the bond amount and the premium will be determined by the creditworthiness of the principal. Which provision encourages the insured to maintain a certain limit of insurance.

NAME SCHEDULE BOND. On October 2 2014 the Trustees of The Eudora Funds unanimously passed the following resolutions. Coinsurance B Insuring Agreement C Limit of Liability D Replacement Cost.

A named schedule bond. Paul Fire and Marine Insurance Company insuring the Funds is attached as Exhibit 1. Business service bonds are those which protect you against any kind of damage or loss incurred when your employees enter the home of a private citizen to provide a business service.

Coverage from its fidelity insurer for mar-ket losses suffered as a result of a dishon-est employees unauthorized trading in and manipulation of a customers account. Buy orders can only be entered on the day of the auction between 8 am. First-party fidelity bonds protect businesses against intentionally wrongful acts fraud theft forgery etc committed by employees of that business.

The bond contained the following provision. The business owner may select from all the following types of coverage EXCEPT A. An individual bond C.

C Court Bond. A copy of the Fidelity Bond the Bond effective June 22 2007 issued by St. Generally the minimum bond amount is 1000.

To qualify for a fidelity bond the job seeker or employee must meet all of the following criteria. The type of bond and nature of the business also may be factors. WHEREAS the Trustees including a majority of the Independent Trustees have reviewed the form and coverage of TravelersSt.

A bond is not required if the owner is the only participant. A Right of salvage. Have a firm job offer or.

You can enter the following order types for fixed income trades. A Individual Bond. 24 All of the following statements about a surety are true EXCEPT A A surety theoretically expects no losses to occur.

Your clients from theft by your employees. Which of the following Employee Fidelity Bonds would cover all employees. Losses from computer forgery d.

How do you get a fidelity bond. Which of the following are optional additions on a fidelity bond. B Reduces the companys need to obtain expensive business interruption insurance.

A Minimizes the possibility of employing persons with dubious records in positions of trust. A fidelity bond which covers the employees listed in a schedule each for a specified amount. Boiler and machinery coverage B.

Provide verifiable proof of authorization to work in the United States. D Position Schedule Bond. To attempt to cancel and replace a bond or CD order.

B The surety has the legal right to recover a loss payment from the defaulting principal. Fidelity Bonds are also called Employee Dishonesty Bonds or Business Service Bonds though these are technically different types of Fidelity Bonds. All of the above 11.

C Allows the company to substitute the fidelity bonds for various parts of internal control. All of the following are types of Fidelity Bonds except. All of the following are types of Fidelity Bonds except.

Or authorized to give or execute any bail bond such bail bond may be given or executed by such principal and any corporation authorized by law to act as surety subject to all the provisions of this Chapter regulating and governing the giving of bail bonds by personal surety insofar as the same is applicable. D The principal is the party who agrees. A bond premium typically ranges from 1 percent to 15 percent of the bond amount.

The party protected by the bond against loss.

Fidelity Review 2022 Pros And Cons Uncovered

Central Mediterranean 1590 Portolan Atlas Of The Mediterranean Sea Western Europe And The Northwest Coast Of Africa Vintage Illustration Northwest Coast Sea Map

Used High End Audio Equipment For Sale Expensiveaudioequipment Shure Headphones Headphones Earphone

Senior Life Insurance Various Types And Sample Rates For Each By Age Life Insurance For Seniors Term Life Insurance Quotes Life Insurance Quotes

An Ancient Giant Humans Grave Is Discovered In Athens New York Poster Prints Art Day Canvas Prints

Visual Culture Selections From The World A Reggae Poster Art Show Reggae Art Reggae Artists Reggae

Strong Performing Bond Managers May Have Better Odds Of Future Success Morningstar Management Success Bond

529 Plan Investment Options Fidelity

How To Invest An Essential Guide For Beginners Get Rich Slowly

Fidelity Bond Insurance Coverage Claim Exclusions

Picking The Losers Is Easier Than Picking The Winners In The Stock Market In 2021 Stock Market Loser Fall From Grace

79 Best Husband Quotes With Images Love Quotes Sayings Husband Quotes Best Friend Quotes Love Husband Quotes

Bits Of Truth Quotes About Love And Relationships Inspirational Quotes Words Of Wisdom

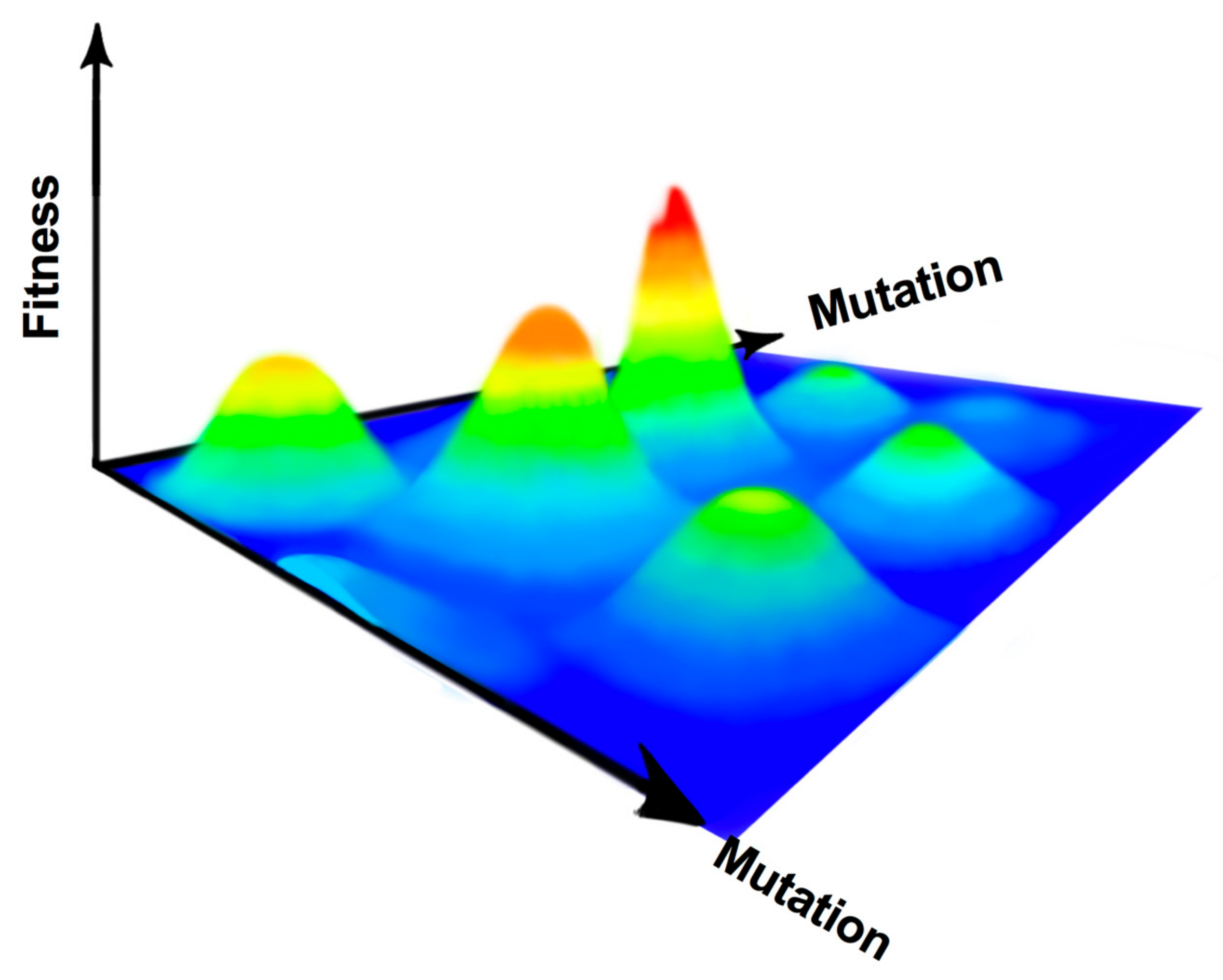

Viruses Free Full Text Rna Virus Fidelity Mutants A Useful Tool For Evolutionary Biology Or A Complex Challenge Html

Dna Replication Fidelity Journal Of Biological Chemistry

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources Small Business

Comments

Post a Comment